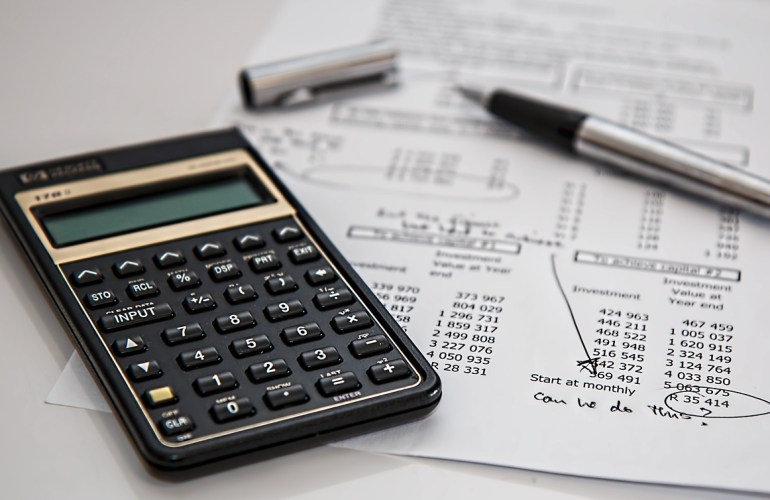

In today’s uncertain financial climate, investors are constantly seeking ways to safeguard their wealth and ensure financial stability. One of the most effective strategies is investing in precious metals—specifically silver. While gold often dominates the conversation, silver offers unique advantages that make it a smart choice for both new and seasoned investors. This guide explores the benefits of investing in silver, as well as how to buy and sell silver with confidence.

Why Choose Silver for Investment?

Silver is more than just a valuable metal; it’s an affordable, accessible, and versatile investment. Here’s why silver deserves a place in your portfolio:

- Affordable Entry Point: Unlike gold, silver offers a lower price point, making it more accessible to investors with smaller budgets. You can begin your silver investment journey without needing significant capital.

- Industrial Demand: Silver is not only a store of value but also an essential component in various industries, from electronics to renewable energy technologies. This industrial demand supports its long-term value.

- Hedge Against Inflation: Like other precious metals, silver acts as a hedge against inflation. When currency values fluctuate, silver often maintains or increases in value, providing stability in times of economic uncertainty.

- Tangible Asset: Owning physical silver—whether in the form of coins or bars—means you hold a tangible asset that isn’t tied to the performance of any one currency or economy.

How to Buy Silver: A Step-by-Step Guide

If you’re looking to invest in silver, the first step is understanding the types of silver products available and where to purchase them.

Types of Silver to Buy

- Silver Bullion Coins: Coins are a popular choice for silver investors due to their liquidity and ease of storage.

- Silver Bullion Bars: Silver bars are often preferred by large-scale investors for their lower premiums and compact storage.

Whether you choose coins or bars, ensure you’re purchasing from a reputable dealer. If you’re interested in buying gold Melbourne, Ainslie Bullion offers a diverse selection of silver bullion products that cater to every level of investor, from beginners to experienced individuals.

Factors to Consider Before Buying Silver

- Purity: Ensure that the silver you’re buying is 99.9% pure to guarantee the best investment quality.

- Premiums: Consider the premium over the spot price. Premiums include the cost of production, distribution, and the dealer’s profit margin.

- Storage: Physical silver needs to be stored securely. You can choose to store your silver at home in a safe or utilize a professional storage service.

Selling Silver: Maximize Your Return

At some point, you may decide to sell your silver and realize the gains from your investment. Timing and method are crucial to getting the best price for your silver.

When Is the Best Time to Sell Silver?

- Market Conditions: Sell during times of high demand or economic instability when silver prices tend to rise.

- Investment Goals: If your investment goals have been met, or you need liquidity, it may be the right time to sell.

Where to Sell Silver

Reputable dealers like Ainslie Bullion provide a seamless process for selling your silver. They offer competitive prices based on the current market rate, ensuring that you receive the best value for your investment.

Why Choose Silver Over Other Investments?

Silver’s unique properties set it apart from other investment options. Compared to gold, silver has a higher potential for price appreciation due to its industrial uses. It’s also a more affordable entry point for new investors who may not have the capital to invest in gold. Moreover, the versatility of silver as both an investment and a commodity makes it a valuable asset in any portfolio.

Final Thoughts: Securing Your Financial Future with Silver

Silver offers a reliable and strategic way to diversify your investments. Its affordability, demand in various industries, and role as a hedge against inflation make it an attractive option for those looking to secure their financial future.

Whether you’re ready to start your silver investment journey or want to liquidate your holdings for profit, Ainslie Bullion provides expert services for buying and selling silver. Their extensive range of silver products and transparent pricing make it easy to invest with confidence.

Invest in silver today and take the first step toward financial stability and long-term wealth preservation!